Intel delivered a classic “beat and raise” earnings report on Thursday, sending the chipmaker’s shares flying and giving investors confidence that a rash of bad news is not taking a big toll on the company’s business.

Intel’s data center business helped drive the company’s strong revenue growth during the first three months of the year. But even Intel’s PC business, which is contending with an industry shift from computers to mobile devices, managed to grow 3% from the prior year.

Intel’s business outlook for the current quarter and the rest of the year were also above Wall Street targets.

Shares of Intel increased roughly 8% in after hours trading on Thursday.

Here's what Intel reported:

- Revenue (GAAP) for the quarter was $16.1 billion, up 9% from the year before. Analysts expected $15.05 billion.

- Earnings per share (adjusted) for the quarter were $0.87, up 32% from the year before. Analysts expected $0.72.

- Q2 revenue guidance (GAAP) is $16.3 billion. Analysts expected $15.55 billion.

- Q2 earnings per share guidance (adjusted) is $0.85. Analysts expected $0.81.

- 2018 revenue guidance (GAAP) is $67.5 billion. Analysts expected $65.06 billion.

- 2018 earnings per share guidance (adjusted) is $3.85. Analysts expected $3.56.

Intel's earnings report comes amid industry-wide concerns over the impact of recently-discovered security vulnerabilities in chips. News reports that Apple is considering designing its own laptop microprocessors, potentially replacing Intel's chips, have also raised concerns.

Intel's Q1 results were released during a busy day of tech earnings reports including:

And better-than-expected results from Microsoft, thanks in part to the company's cloud business.

Data products power

Intel's data products grew 25% from the year before, and ultimately made up a full 49% of the company's quarterly revenue. Intel's PC business brought in $8.2 billion in revenue during the first three months of the year, up 3% from the year before. Intel's flash memory business grew 20% as strong demand for storage continued.

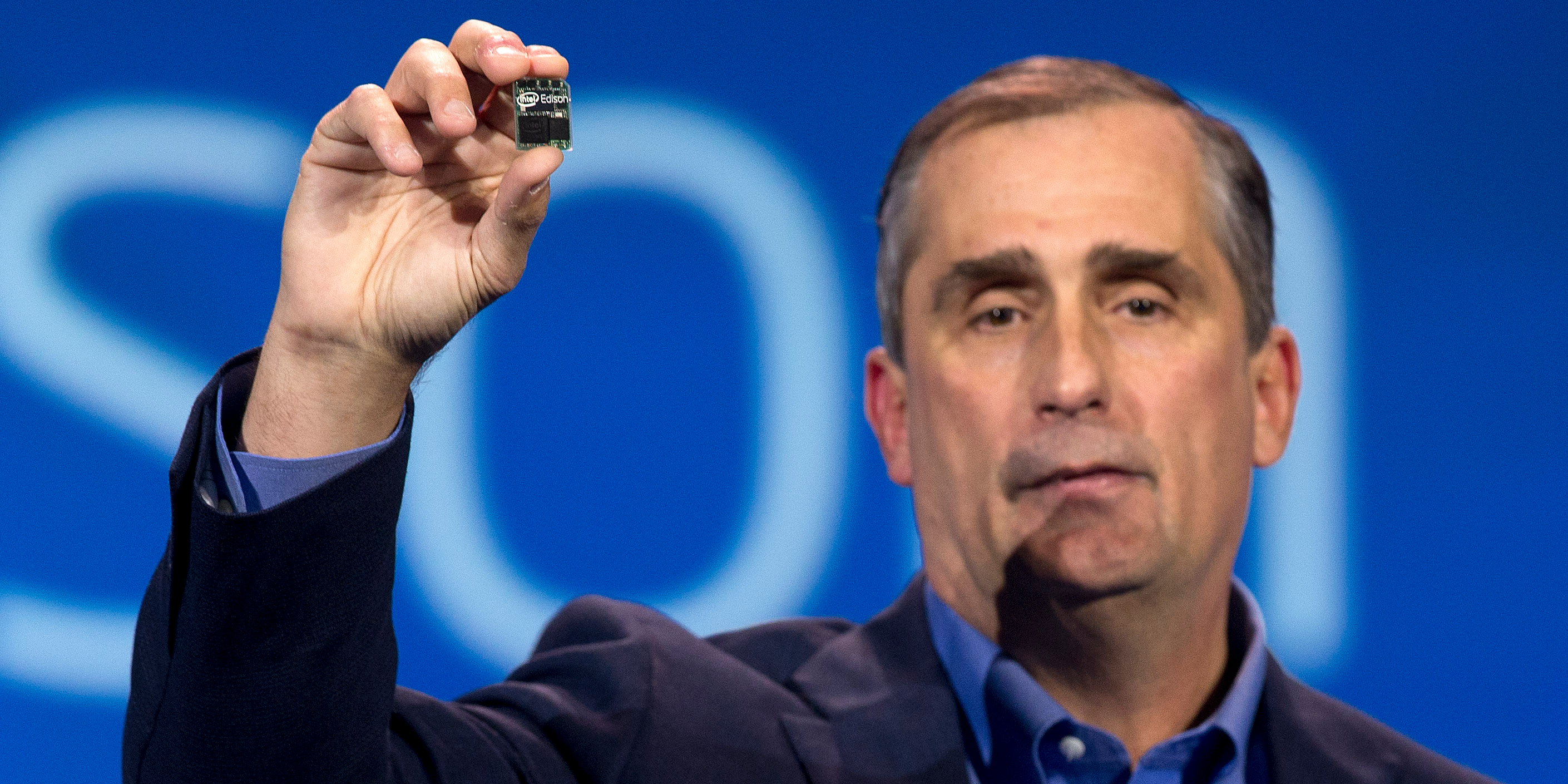

"The strength of Intel's business underscores my confidence in our strategy and the unrelenting demand for compute performance fueled by the growth of data," CEO Brian Krzanich said in a statement.

The chipmaker said it would begin rolling out improvements to its manufacturing operations at the 14 nanomenter node later this year, and that it expects to shift to volume production at the 10 nanometer node in 2019.